Award-winning PDF software

Real estate addendum to extend closing date Form: What You Should Know

WHEREAS, the Contract must be signed by both parties before the Contract expires by the terms and conditions aforesaid; and WHEREAS, the party or parties seeking said amendment to the Contract must give the other party a reasonable time frame or notice to consider the said amendment; and WHEREAS, said time frame, or stated period must be at a minimum of 45 days from the date the first written communication is received; and WHEREAS, said written communication must contain the information prescribed by the rules of the court, specifying the facts upon which the amendment is sought, and a description of the specific agreement or contract to be amended; and WHEREAS, said written communication must be received by the other party no earlier than 9:00 a.m. MST; and WHEREAS, the time frame required by this Amendment to the Contract shall commence and may only be expired by an order of the court: Now, THEREFORE, in consideration of all the agreements set forth above, I, Richard M. Dauphins, Attorney General of the State of South Carolina, do hereby determine that the property described in the Contract is the property described in the Contract and amends the contract to read as follows: PART 1 — GENERAL PROVISIONS Sec. 1. 1. A GENERAL RELEASE DOES NOT EXTEND THE TERM OF THIS CONTRACT OR THE TERMS OF ANY OTHER AGREEMENT TO BUY OR SEND PROPERTY IN THIS STATE OR TO MAKE ANY OTHER PROVISION IN CONNECTION WITH THIS CONTRACT. 2. THE CONTRACT EXPLAINS A CONTRACT BETWEEN THE PERSON ENTITLED TO THE MONEY IN THIS CONTRACT AND THE PERSON INTENDING TO BUY, SEND OR MAKE THIS CONTRACT. The “Person” of this Contract is THE UNLAWFUL CONTROLLER. The “Person” has the privilege to do all acts which are necessary to the accomplishment of the terms of this Contract.

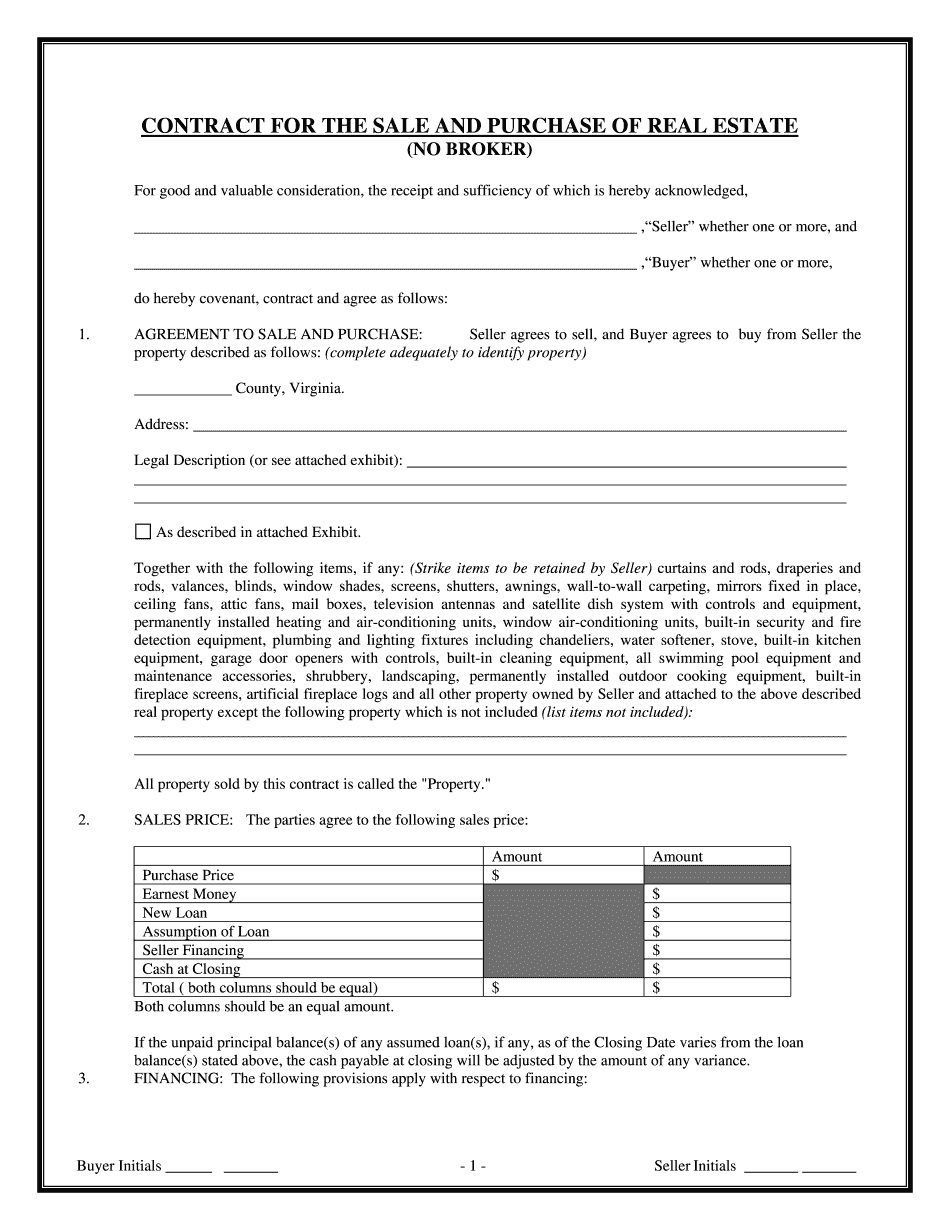

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.