Since 1944, the VA loan program has helped millions of servicemembers, veterans, and military families achieve the dream of homeownership. This flexible, no downpayment program was part of the original GI bill. Seven decades later, it's in many ways more important now than it's ever been. What's also important is understanding that the government doesn't make home loans. In the case of VA loans, the Department of Veterans Affairs provides a partial guarantee. It's basically like a form of insurance for each loan. The guarantee on FHA and USDA loans is a little bit different, but the underlying idea is the same. With all three of these, you're getting a government-backed loan from a mortgage lender, not a home loan directly from the government. With VA loans, the government backing gives lenders, like Veterans United, the ability to provide financing along with some big-time benefits, many of which can't be matched by any other lending option. So, given that backdrop, let's take a closer look at VA home loans. Being able to buy with no down payment is the single biggest benefit of VA loans. Most other types of home financing out there will require one. It's typically three and a half percent for FHA loans and five percent for conventional. So, on a $200,000 home purchase, you're talking about needing seven thousand dollars in cash at closing for an FHA down payment and ten thousand in cash for conventional. Needless to say, it can take years to save that kind of money. The VA loans also don't come with any sort of mortgage insurance. Now, most conventional borrowers will have to pay for private mortgage insurance or PMI, unless they can put down 20% of the purchase price. On a $200,000 home purchase, 20% is $40,000. Now, FHA and...

Award-winning PDF software

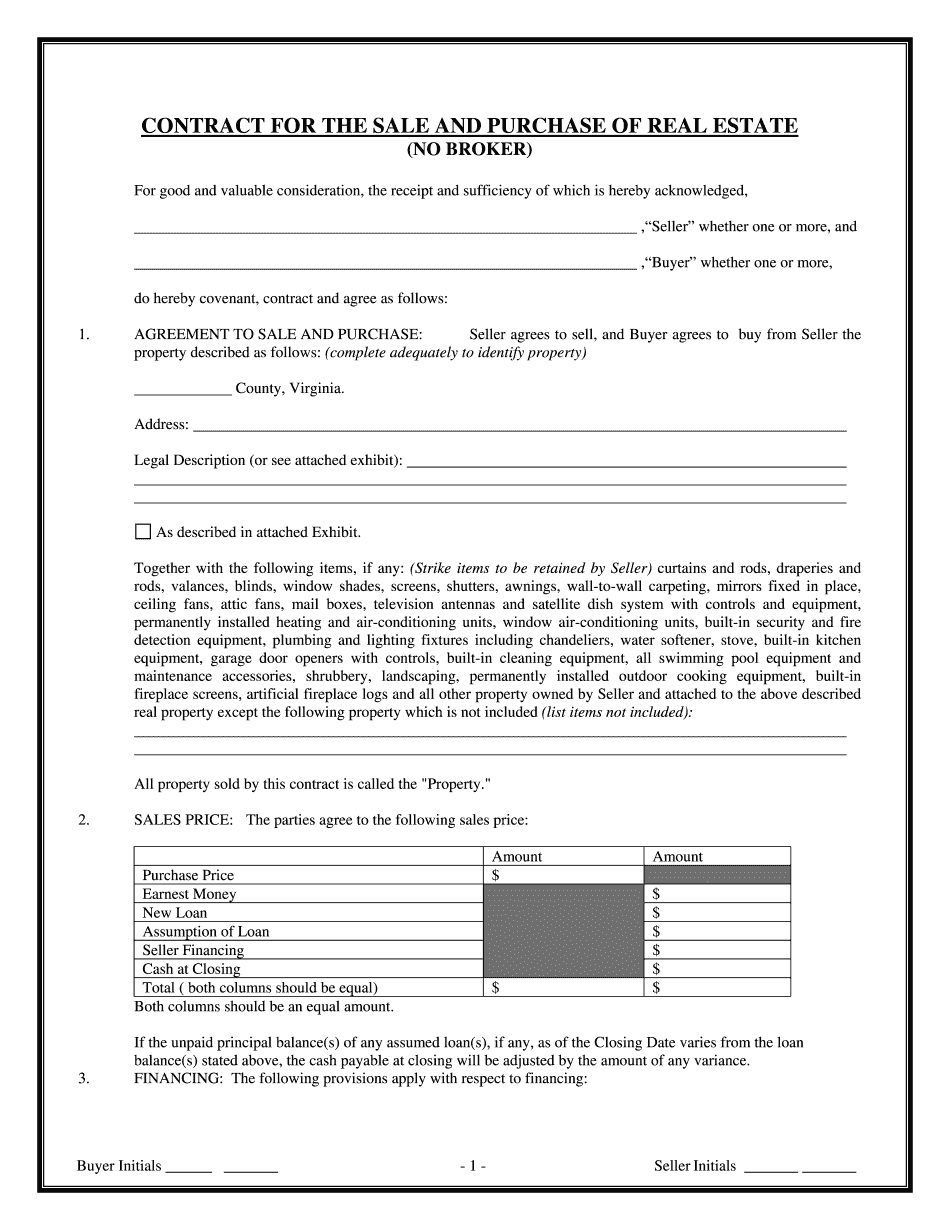

Va installment contract Form: What You Should Know

On the date by which the contract is accepted by the buyer and by which the contract is executed and approved as an installment sale, the transaction is complete, the purchaser and the Seller undertake to sign the following agreement by executing and delivering a written instrument in full before a notary public, who is authorized to perform the same. § 1.2-814.5. Property Sale Agreement The Purchase and Sale Agreement sets forth the specific terms of the purchase and sale of property under this agreement; in addition, it indicates the amount of the purchase price that the property is to purchase and the terms of payment therefor as well as any other terms that the buyer is obligated to pay to the Seller and any applicable taxes and/or fees. Each party, the undersigned, acknowledges the obligation of the other to complete the transaction on or before the end of the business day following the acceptance by the buyer of the Purchase and Sale Agreement, provided however, if the terms and conditions of this paragraph are not agreed in writing by the parties prior to the contract being executed and signed by such parties, including in writing any provision in respect to additional sums to be paid under the purchase and sale agreement or otherwise to be paid to the other party under the purchase and sale agreement, the contract shall be void, and the consideration paid to the seller shall constitute no consideration for the purchase, sale and conveyance and the whole thereof shall be null. (§ 1.2-811.6.2.a) § 1.2-811.6.2.b. (a) Informing Seller that the buyer (1) Does not need a real estate agents license, and (2) Is Not a person that uses real estate agents in connection with selling or purchasing or both. (§ 1.2-811.8.1.a) § 1.2-811.9. Notice to Buyer of Terms The purchaser, once it has received all required information prior to completing the transaction, will give Seller the notice required by the Virginia Real Property Law by mailing a copy of the completed form to the buyer at the address as supplied to the purchaser in the completed form. § 1.2-812.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Va installment contract