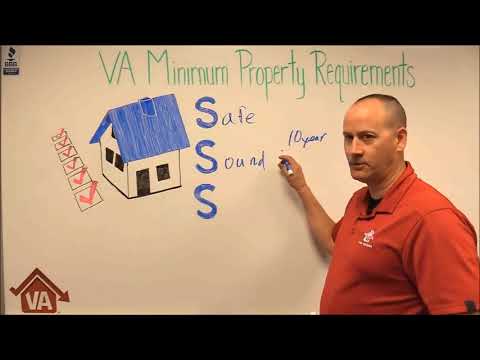

Music, hey! Happy Friday afternoon to the lovely veterans. Thanks for joining us again today. Today, we've got a fun topic we're going to talk about: VA minimum property requirements. There are 3 S's associated with that, but these are not the same 3 S's that the first sergeant used to yell at us in the morning before first formation. Totally different than those asses. The first one we're going to talk about today is safety. Remember, the VA home loan program was created to make sure that veterans are able to buy houses for their families and take care of them. So, the first aspect of that program is safety. The VA has specific minimum property standards regarding the safe, sound, and sanitary conditions of a home that a veteran may purchase. Remember, the VA home loan program is not intended for Extreme Home Makeover-type stuff. Let's talk about safety. One of the things we're looking at here is access. You have to have access to the property. Now, this could be as simple as maybe having a shared driveway. Depending on where you live, out in the country, you have to make sure you learn about the easement, in case you have a neighbor that you don't get along with. Maybe you're an army guy and your neighbor is from the Air Force, and you sort of don't play well. So, you both have to have access to your property. The other thing to remember is if there's a private road agreement. Please, please remember this, private road agreements are something that's unique to the veteran community. For example, if this is our road and our veteran's house is down here, and you have another veteran's home here, and another home, you have to make sure there is a private...

Award-winning PDF software

Va appraisal contingency Form: What You Should Know

Va Financing Contingency — Fill Online, Fill PDF Va Financing Contingency — Fill Online, Printable Apply VA Insurance. Buyer must enter VA insurance information in Purchase Contract. VA Insurance VA Contingency Addendum — Fill Online, Fill PDF Apply VA Indemnity. The seller must enter the following information within the Purchase Contract: Vendor's Name, Full Name, City of and state of residence and a description of your goods. Note: If you must provide a POA, please enclose it. RVA Seller Assistance Program VA Contingency Addendum — Fill Online, Fill PDF VA Contingency Addendum — Fill Online, Fill PDF Apply VA Loan. The seller must enter VA loan information for your Loan. VA Loan VA Contingency Addendum — Fill Online, Fill PDF VA Contingency Addendum — Fill Online, Fill PDF Apply VA Insurance. The seller must enter VA Contingency Addendum — Fill Online, Fill PDF VA Contingency Addendum — Fill Online, Fill PDF Apply VA Indemnity. The seller must enter the following information within the Purchase Contract: Vendor's name, Full Name, City of and state of residence and a description of your goods. Note: If you must provide a POA, please enclose it. RVA Seller Assistance Program (SAP) VA Contingency Addendum — Fill Online, Fill PDF Virginia State of Mind. For Purchase Contract to be Acceptable in Your State, the following must be included in Purchase Contract: a sales contract approved by the seller who has not Controlled VA Title Insurance from a local Title Service. ( Controlling VA title insurance) the VA Title Services has not controlled the Seller's VA Loans. ( Not currently in control of VA Title Insurance) Note that the seller is responsible for the control of the VA Loans even if this state is not the seller's state of Mortgagee's (or purchaser) state! VA Title Services. ( Title Services) If Seller has control of VA Loans, they must Maintain and update their current Vols for all VA Title Loans. ( Title Services) They must be able to verify the full-time TitleServices personnel who maintain the VA Insurance on your VA Loans.

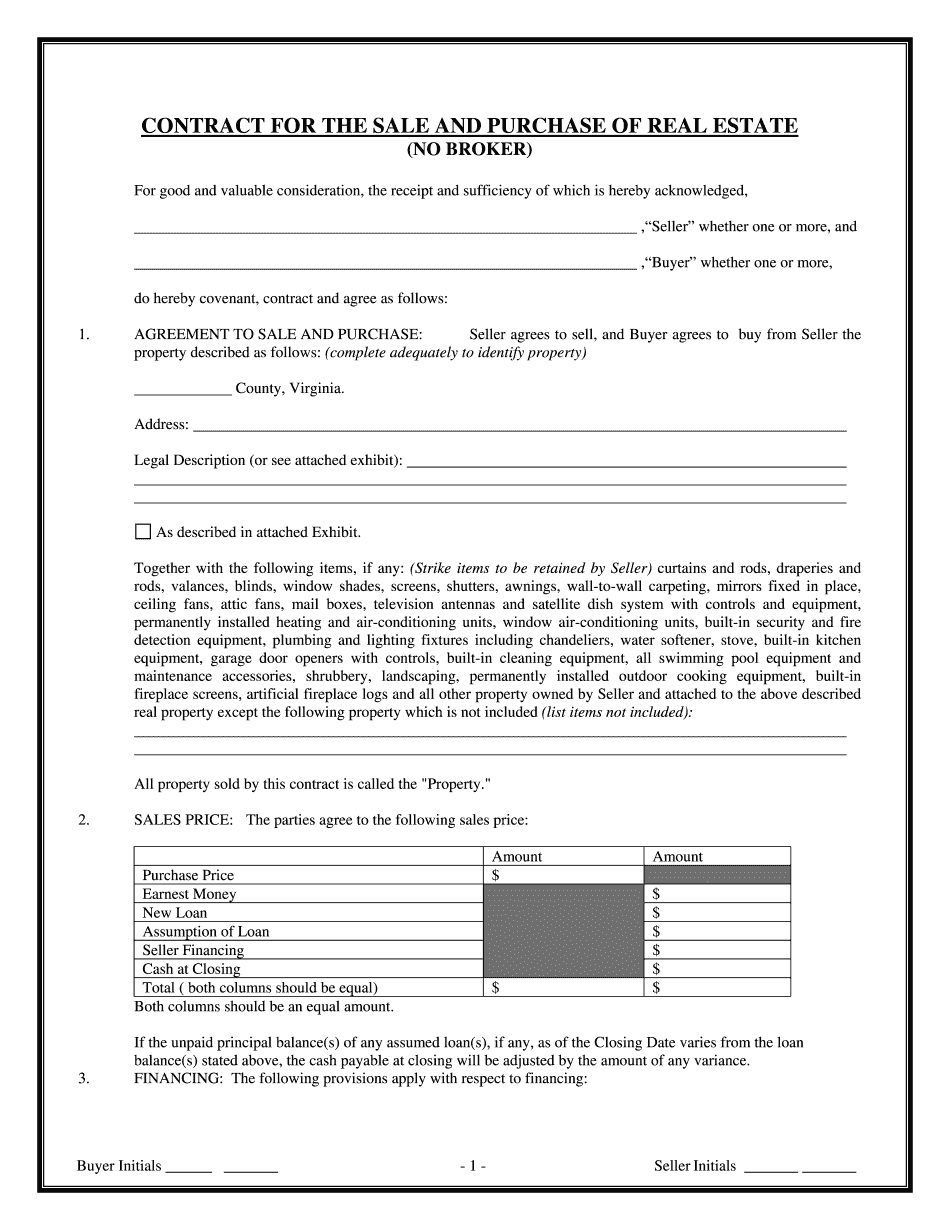

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Va appraisal contingency