Good afternoon, everybody. Welcome to my training. Hey, before we get started, can I get everyone to make sure your doors are shut and your other devices are turned off? I'm going to cover quite a bit of information in a short period of time, so I need your full attention. Also, everyone on this call will receive a copy of this training and the material at the end of the broadcast. My name is Krista Field, and I'm an account executive for New Line Mortgage. This class is a part of a series of classes designed for loan officers that are either new to purchase loans or need a refresher. For about the next 30 minutes, we're going to review a VA Rep C, discuss the different provisions and documentation requirements, and also discuss some questions you should be asking your Realtor, and how to recognize potential documentation requirements. I'm also going to leave you with a nice little interview form that you can use to help structure your conversation with your Realtors. Also, before we get started, I'd like to take a moment and ask for your business as an AEM paid Commission. So, the best compliment you can give me is to send me a loan if you find this training useful and learn something new. Please send me a loan on any product. New Line does offer some great FHA, VA, conventional, and USDA pricing right now. I also have many other trainings available on all of these products. Just give me a call and let me know if you need. Alright, let's get started. So, on the purchase contract, our loans all purchase loans require a properly executed purchase contract, including all addendums. Purchase contracts can vary per state. This training highlights the Utah purchase contract,...

Award-winning PDF software

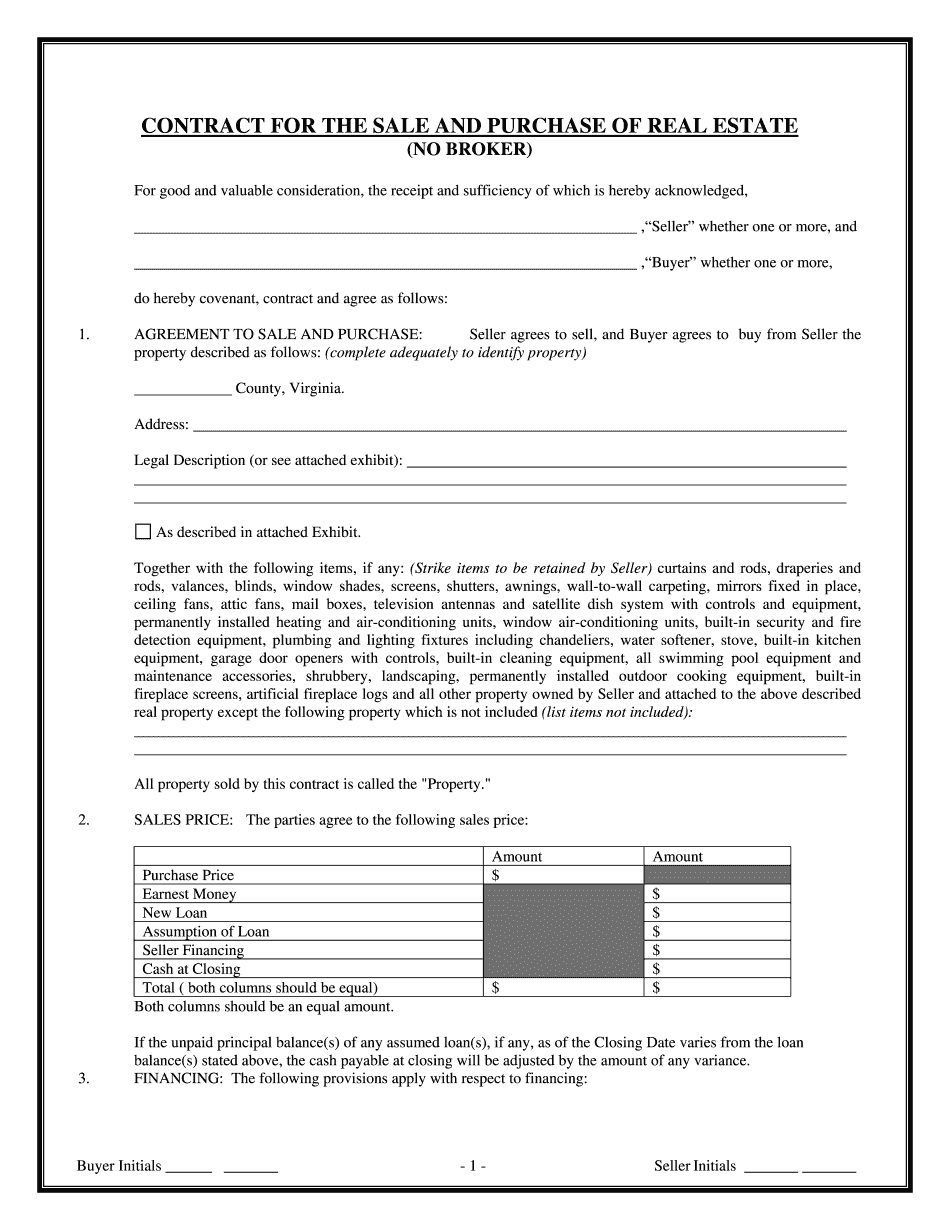

Virginia realtors residential contract of purchase Form: What You Should Know

Notice”) This sales contract is offered in the State of Virginia and is governed by the Virginia Real Estate Acquisition, Acquisition, and Sale Act (“Act”). This form is intended to provide you with the information you will have to fill in and sign before you can proceed with this contract. Please be advised that this form is not an offer of sale and is merely intended to help you fill out and sign the form before signing and taking possession of the goods You are responsible for obtaining all necessary licenses, permits and other information required to complete this form. If you need more information or help completing these forms, feel free to call or visit any of the following offices.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

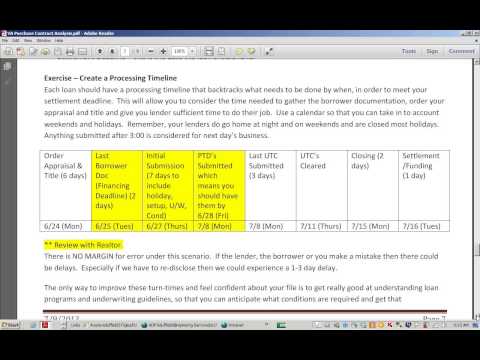

Video instructions and help with filling out and completing Virginia realtors residential contract of purchase