This video is to explain the third-party financing addendum. 2. I'm gonna go over the whole thing and explain in detail. 3. I'll tell you what's putting the blanks. 4. I'll explain it a little bit from the buyer's perspective, the seller's perspective, and I'm going to give you a bunch of answers that will probably answer a bunch of questions that you have. 5. So, real quick, let's just kind of cover the function of this form and when to use it. 6. You would use this form anytime you're helping a buyer purchase a property and they're going to use financing. 7. It's basically for the most part any kind of financing that's not owner financing or seller financing. 8. So, anytime they're going to a bank or getting a lender to loan money, you want to use the third-party financing addendum. 9. The function of this addendum in general is that it ties the approval process to the contract. 10. So, if the property or the buyer can't approve for financing, then the client has some protection there and they have the ability to get out of the contract and get their earnest money back. 11. So, let me just kind of cover the whole thing in general and then I'll dive in deeper. 12. So, it's got several different paragraphs here. 13. Paragraph a is talking about the duties of the buyer. 14. Then it gets into the different types of financing that the buyer can use. 15. So, you're only going to use one of these sections here most likely. 16. I don't know if you need a situation where you'd use two different kinds of loans, but who knows, right? 17. So, then Section B goes into explaining the timeline and just what's approved...

Award-winning PDF software

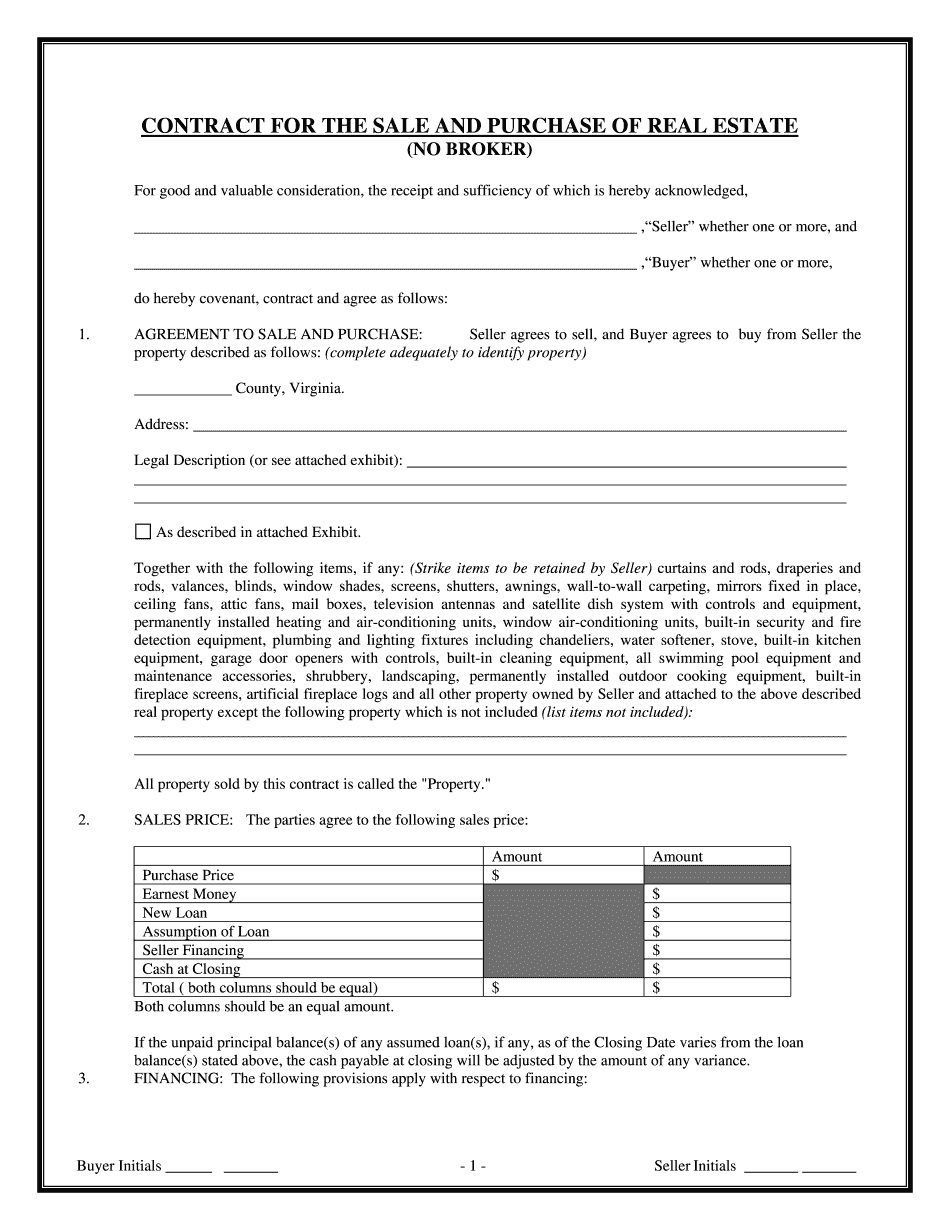

Addendum to real estate contract florida Form: What You Should Know

The undersigned Seller wishes to offer the Buyer a counter offer to the sale of the subject premises by (the undersigned Sellers) to the Seller(s). The offer provided by (the Seller) is subject to these conditions:(1) The Seller agrees to accept and execute a Contract for sale and purchase (“Compacts”) by the Buyer(s), to be signed by both parties in the presence of a Notary Public; (2) The Sale will be a sale under Uniform Arbitration Rules and all disputes shall be commenced and litigated in the United States Courts for the Southern District of Florida (Fort Lauderdale) by the sole and exclusive jurisdiction of that court; and (3) The Seller shall not attempt to assign the Compacts or otherwise make the Buyer dependent upon the Sellers. The Seller hereby agrees to be bound by the terms of the Compacts or any amended Compacts, if any, and to execute and deliver a new Contract for sale and purchase by the Buyer to the Buyer on behalf of the Buyer on the date of the sale. The Seller's notice of a sale is deemed given one (1) business day before the effective date of the sale. (Dated the . ) COUNTER OFFER ADDENDUM — NEFAR.com. ADDENDUM TO CONTRACT ADDENDUM To the Members' Contract Regarding Contract No. S, dated. . . Date: January. . . 18, 2005. The Seller and Buyer are hereby informed and agree as follows: The Seller hereby acknowledges that (1) the real property described as:. . . (Seller) and. (Buyer) was previously sold pursuant to this contract, subject to Buyer's default in accordance with Article 14, (2) Seller did not receive a written offer for sale, but accepted written offer from Buyer, dated. . . (Buyer) and. . . (Seller), (3) Sellers previous offer was accepted by Buyer as a counter-offer in this sale, and (4) Seller's prior offer and Buyer's counter-offer were for the same amount. Seller hereby acknowledges and agrees that the Seller's prior and current offers are not negotiable, and that Seller has no right or obligation to rescind seller's prior or current offers of the same item or price. Sellers will have no further obligation to the Buyer with respect to this Sale.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Addendum to real estate contract florida