I just want to give you a video this morning. It is entitled "How to Get a Piece of Property for $100". This concept revolves around property taxes. Throughout all 50 states in the United States, there are people who own property and pay property taxes. Oftentimes, people can go two, three, four, five, sometimes seven years before entering into a situation called property tax foreclosure or delinquent property taxes. This occurs when people fall behind on property taxes and the local city or county pushes for a foreclosure on the property to get the unpaid taxes paid. There are cases where people lose properties worth hundreds of thousands or even millions of dollars due to unpaid property taxes. The reasons behind falling into property tax foreclosure can be medical issues, income problems, divorce, or other unexpected life events. This concept is not about tax lien auctions or foreclosures, but rather about the period between falling behind on taxes and the property going to auction. This method can work well with land, houses, commercial properties, and farms. To find out more, you can contact your local city or county and search for information on property taxes. For example, if you live in Houston, Texas, you can search for "Houston Texas property taxes" to find the tax assessor's office. This office is usually the point of contact to discuss delinquent property taxes. Although the name may differ in various areas, in Atlanta, Georgia, it is called the property tax assessor's office or the tax assessor's office.

Award-winning PDF software

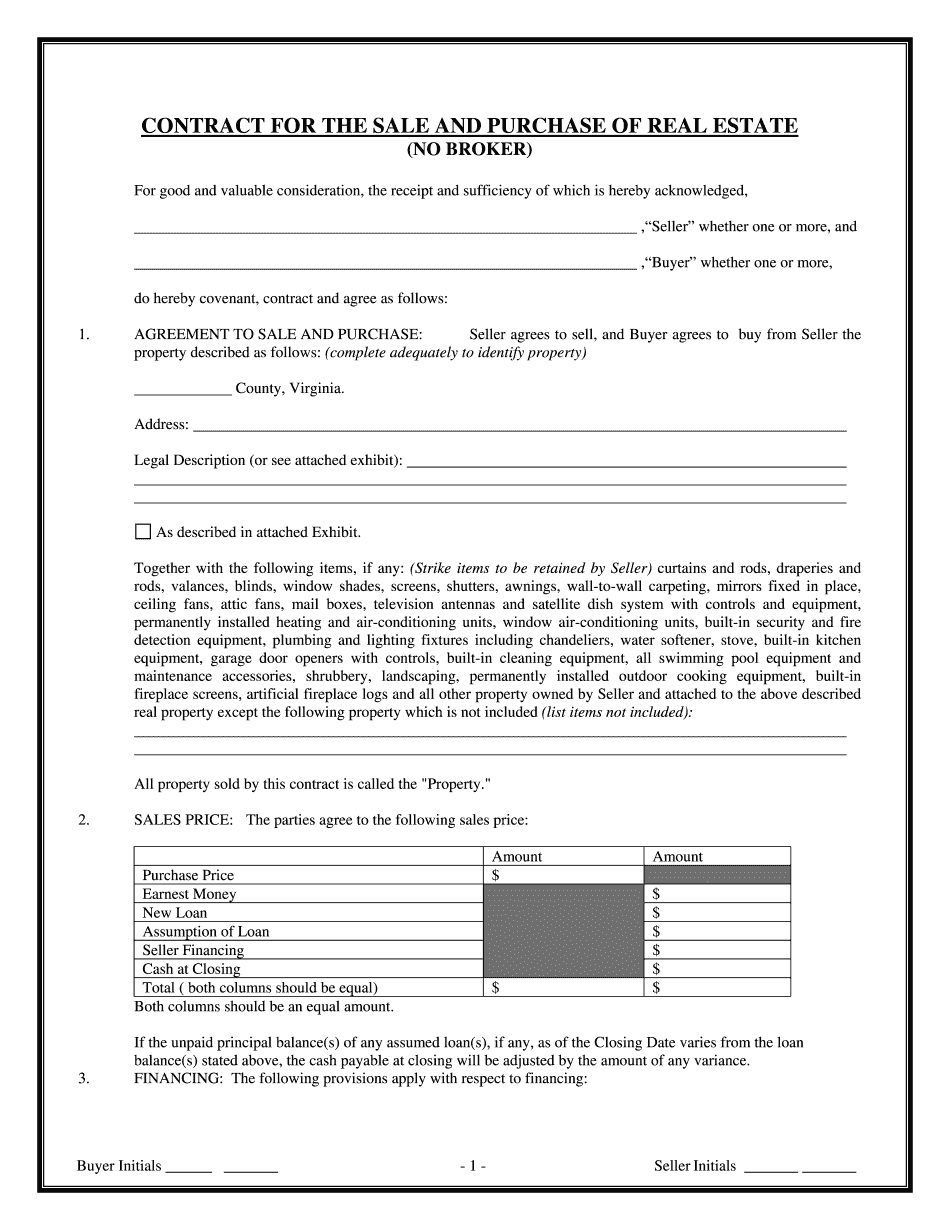

Free Virginia Real Estate Purchase Contract Form: What You Should Know

Code Ann. § 18.2-63 (2018). It is completed using the Virginia Residential Purchase and Sale Agreement template and is available for download at Virginia Residential.com. There are over 200 pages. Virginia Residents only Virginia Residential Purchase/Sale Agreement — PDF Virginia REALTOR Residential Contract of Purchase — PDF Virginia Real Estate Purchase & Sale Agreements — forms Virginia Residential Property Purchase and Sale Agreement — forms Purchase and Settle/Sale Agreement & Certificate VA REALTORS Residential Contract of Purchase — PDF Virginia Residential Property Purchase and Sale Agreement — PDF Virginia Residential Contract of Purchase — 2019-07 Fillable Virginia Resident Property Purchase and Sale Agreement — PDF The Virginia Residential Property Purchase and Sale Agreement is a legally binding contract between an adult owner and real estate broker for the sale or lease of a piece of real estate. It must be completed using the Virginia Residential Property Purchase and Sale Agreement Template and is available for download at Virginia Residential.com. There are over 200 pages. Virginia REALTORS Virginia Resident Property Purchase and Sale Agreement Template Virginia Real Estate Purchase and Settle/Sale Agreements — forms VA Real Estate Property Purchase and Sale Agreement — PDF Virginia Real Estate Purchase and Sale Agreement Template (2016) View PDF Virginia Resident Property Purchase and Sale Agreement — PDF The Virginia Resident Property Purchase and Sale Agreement is a legally binding contract between an adult owner and a Real Estate Broker for the sale or lease of her/his piece of real estate. The document is completed using the Washington State Residential Property Purchase and Sale Agreement template and is available for download at VirginiaRealestate.com. There are over 200 pages.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Free Virginia Real Estate Purchase Contract