Hello, this is Tim Brooks with the Brooks Group and the Ultimate Selling Team at Keller Williams Realty. I wanted to welcome you back for our training on the Maryland purchase contract addenda. This is going to be an interesting training session, and we're going to cover what paperwork actually goes with the core contract that's submitted by the buyer. This paperwork is not provided by the seller with the initial disclosure packet that's usually published online with the property listing. So, what we're going to cover in today's session is all of the different addenda that can be part of the contract that the buyer is going to provide, but not what's actually provided by the seller in their package. These five things can be either the financing addendum, inspection addendum, first-time homebuyer addendum, seller contribution addendum, and finally, the addendum of clauses. Now, the addendum of clauses actually encompasses all of those other things into just one simple addendum. That's why I like to use it rather than having four or five different addenda. This one actually puts all of those together in one document, except for the first-time homebuyer addendum. Also, remember you can go to paragraph 17 of the core contract. If you're not sure what all needs to be included, you can kind of go down that checklist there and see what applies to your specific situation. Then, you'll know what to include and what not to include. Now, the first addenda we're going to go over are the financing addenda. That's conventional, FHA, and VA financing. Conventional financing usually requires a higher down payment, but it offers the best rate and terms and is the cheapest type of money to borrow. Usually, it includes no mortgage insurance. On the other hand, FHA requires only two and a...

Award-winning PDF software

Real estate purchase agreement addendum Form: What You Should Know

You can check the status of your trademark registration at: This is a public document. The terms and conditions in this Agreement, including the clauses and definitions contained herein and the addendum form, are those that are agreed to by the parties or as set forth in the agreement(s) referred to in Sections 8.00 through 9.00. The parties do not intend to add any term(s) to the Agreement that is not set forth in the agreement(s). If the addendum form is provided to the other party, you represent and warrant that it is complete and accurate, that all the requirements of these form(s) have been met and that the addendum is your exclusive remedy. SECTION 8.00 — TERMS OF USE OF THE SERVICES These terms of use of the Services are incorporated by reference into these terms & conditions of your use of the Services. For the purposes of this document these terms of use shall include the terms which are set out in the Agreement. The terms as defined in this section 8.00 shall apply to any account created on or after the date that is two years after the first date of use of the Services after June 26, 2015. Any use of the Services other than this Agreement or the addendum form, without authorization of the parties, is unauthorized and unlicensed. You may view and download the services from or by phone at. If you do not wish to use these services, please delete your account with the real estate professional. You agree to abide by these Terms of Use. If you do not agree to be bound by these Terms of Use, then you must not do any of the things that are contained therein or may result therefrom without the prior written approval of the Company, and you understand and agree that the Company retains the sole right, title and control of the services, information and content (together “Service(s)” and “Content”) that are provided at or through your account(s), to the maximum extent permitted by law, and that you do so at your own risk. The foregoing is not an expression of any assumption by the Company, its affiliates, agents, partners or licensors as to the accuracy of the information, advice, opinions or statements in the Service.

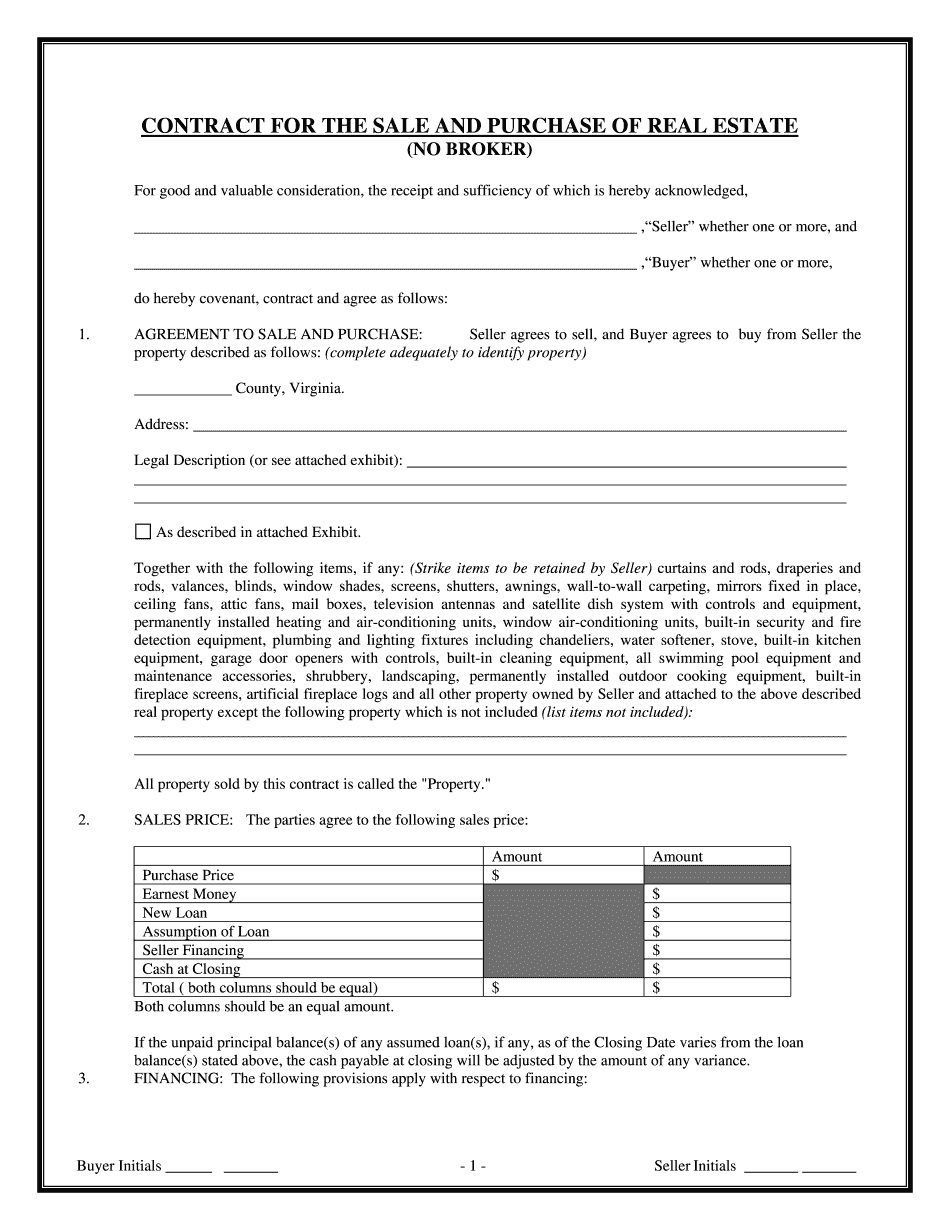

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va Contract for the Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va Contract for the Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va Contract for the Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va Contract for the Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Real estate purchase agreement addendum